GENESIS64™, the intelligent software of Mitsubishi Electric, takes Thai entrepreneurs through the

GENESIS64™, the intelligent software of Mitsubishi Electric, takes Thai entrepreneurs through the "Carbon Tax" trap.

According to situations from around the world that have jointly accelerated various activities in the area of NetZero and/or Carbon Neutral, the future direction of "Carbon Tax" will become an important measure in international trade, for example measures to adjust the price of carbon before entering the border Carbon Border Adjustment Mechanism (CBAM) is a measure that will come into force in 2024 for goods imported into the European Union. Initially targeted industries are cement, electric services, fertilizer, aluminum, iron and steel, before expanding to a number of other industries in the future. While the United States is considering legislation and it is likely to begin levying carbon fees on target industries like CBAM next year. The United States is Thailand's No. 1 export market in many of the main targeted industries involved, and in many other countries, it is inevitable to apply a "carbon tax" to enforce according to the United Nations Framework Convention on Climate Change (UNFCCC).

Therefore, Thai entrepreneurs, especially exporters in industries with a large amount of greenhouse gas emissions, should consider accelerating investment and improving production efficiency in order to reduce greenhouse gas emissions, including establishing a data collection system on reducing/emitting greenhouse gases in standardized production processes to maintain trade opportunities and to increase competitiveness, especially in order to maintain customer bases abroad and to prepare for various environmental measures that will increase more rigorous

Today we have an intelligent software from Mitsubishi Electric Factory Automation (Thailand) Co., Ltd. (MELFT), a company in Mitsubishi Electric Corp. It is a software called GENESIS64™, a SCADA software that can help analyze greenhouse gas emissions in various industries. Provides a real-time visualization of the process of carbon emissions in factories from the hourly, daily, monthly and yearly basis to plan the production system. Control energy consumption and greenhouse gas emissions to not exceed the specified standards or minimizing emissions, which can lead to tax exemptions, tax cuts, or even selling carbon credits to other factories that emit carbon emissions in excess of the standard.

SCADA GENESIS64™ can calculate the carbon footprint of an organization, i.e. the amount of greenhouse gases emitted by an organization's activities such as fuel combustion, electricity use, waste management and transportation, measured in tons of CO2 equivalents. By considering from 3 main parts, divided into SCOPE consisting of

SCOPE I: Calculation of direct carbon footprint (Direct Emissions) from various activities of the organization directly, such as the combustion of machinery, the use of the organization's vehicles (owned by the organization), the use of chemicals in waste water treatment, leakage from processes or activities, etc.

SCOPE II: Calculation of indirect carbon footprint from energy use (Energy Indirect Emissions) i.e. purchasing energy for use in the organization such as electricity, thermal energy, steam energy, etc.

SCOPE III: Calculation of other indirect carbon footprints, employee travel with vehicles that are not the organization, traveling to off-site seminars, using various equipment, etc.

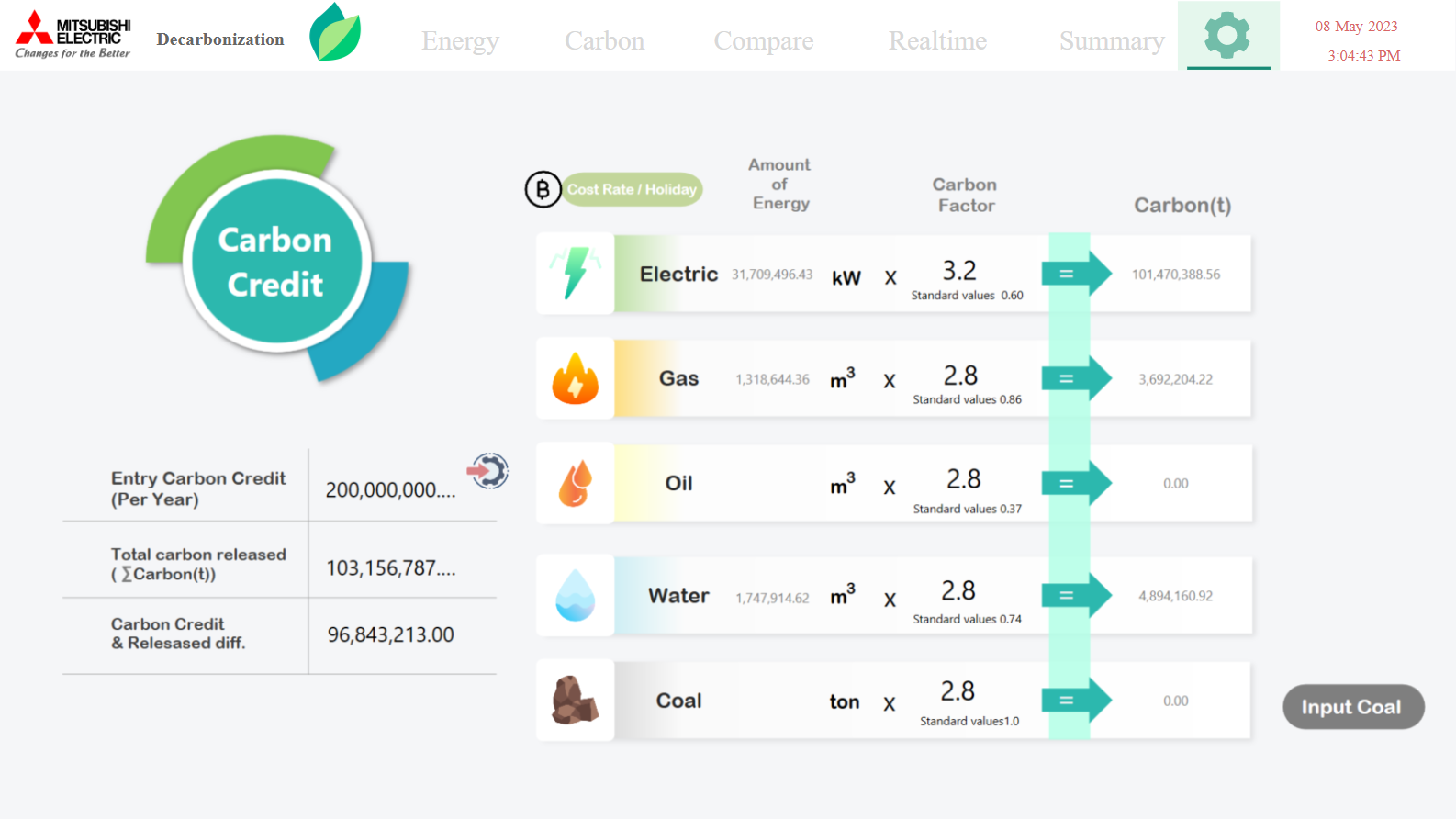

The SCOPE I and SCOPE II are now considered very process intensive, requiring every plant to be in compliance immediately. SCADA GENESIS64™ can calculate how much carbon is emitted to assess the amount of greenhouse gas emissions from corporate activities, identify the causes of significant greenhouse gas emissions, and find ways to reduce the amount of greenhouse gas emissions to reduce greenhouse gas emissions? to be sold as carbon credits or carbon offsets with other organizations

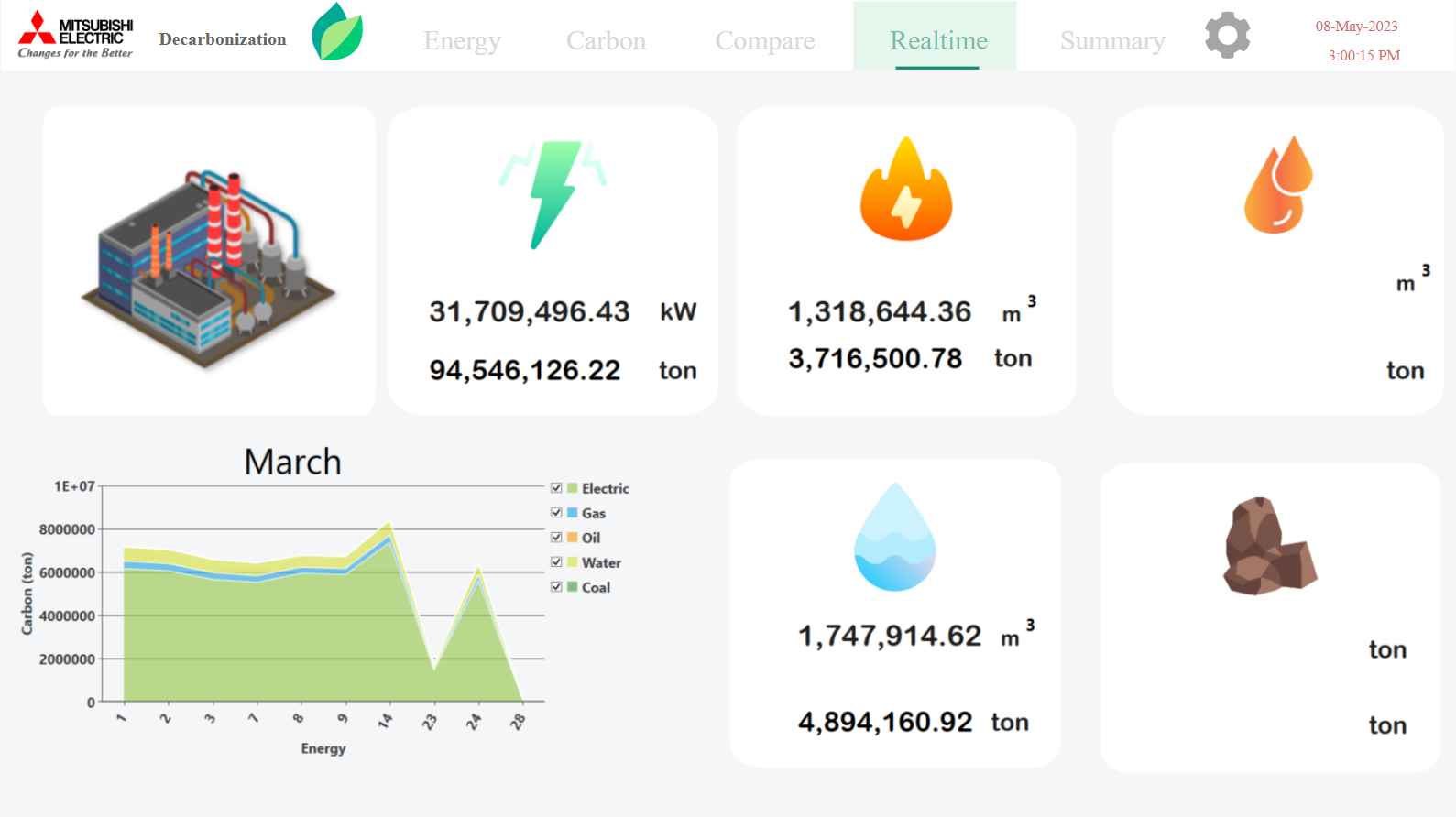

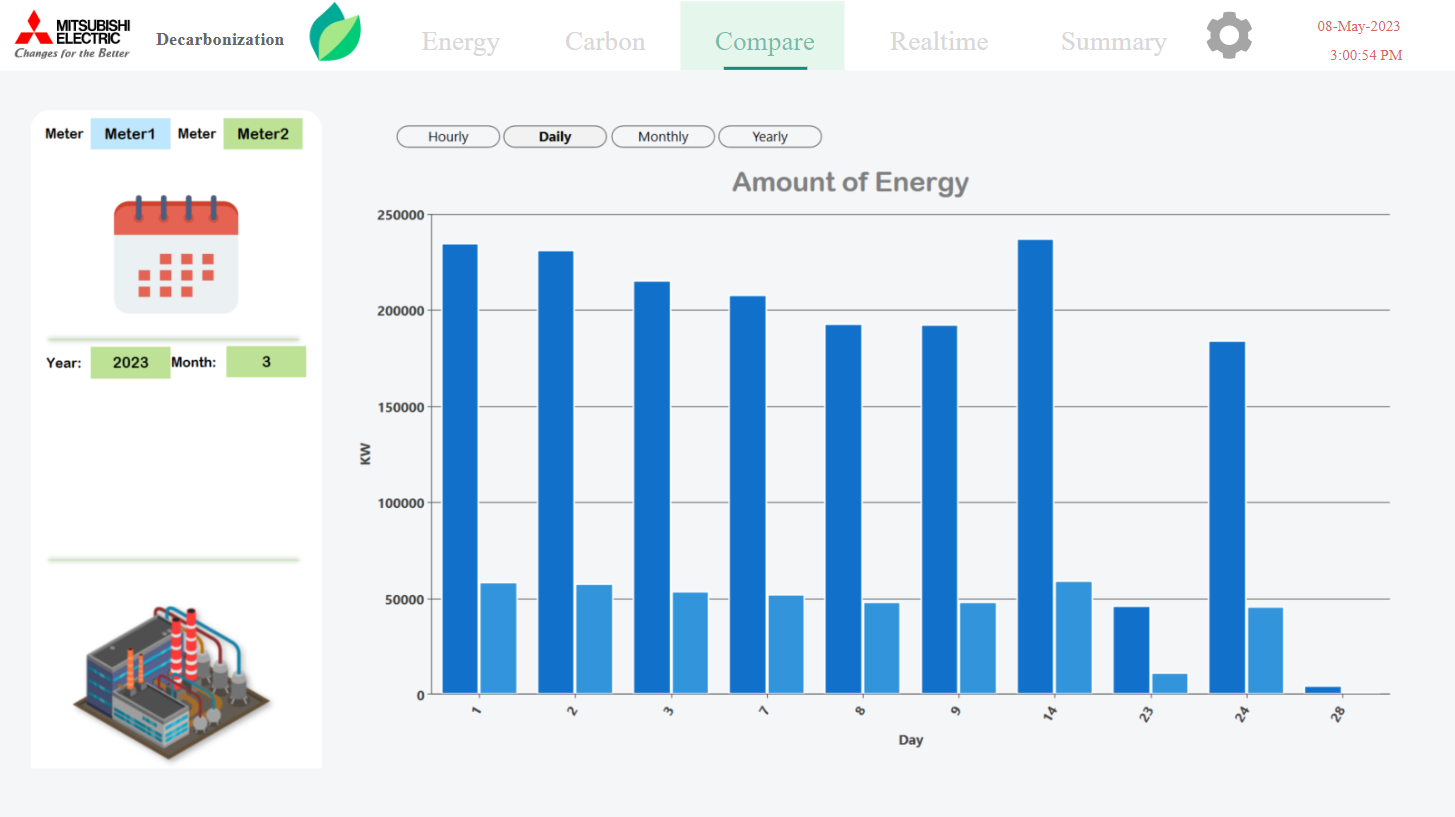

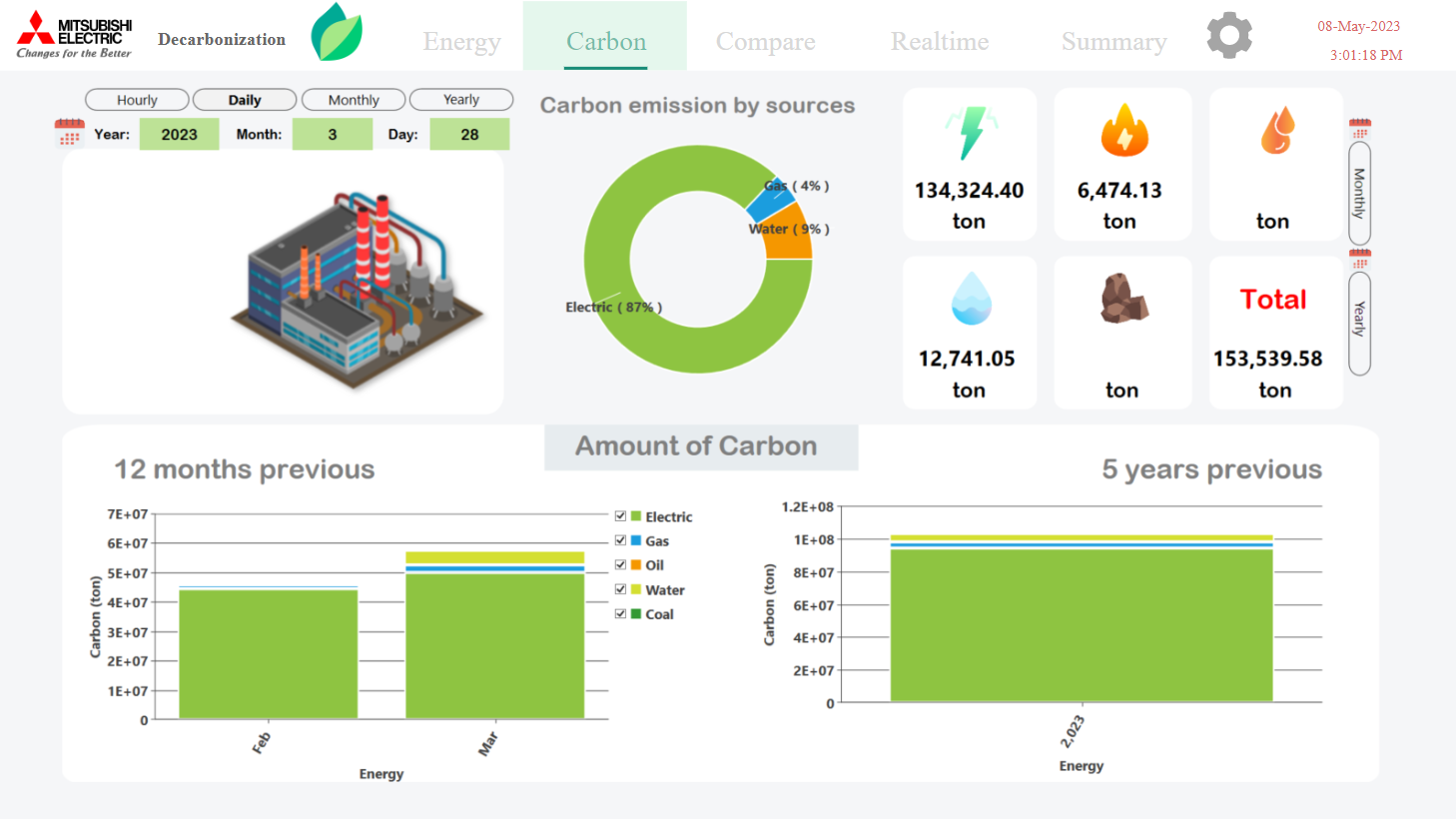

SCADA GENESIS64™ provides functions on templates that operators can easily use even in factories that use multiple sources of energy such as electricity, gas, solar, water, or wind. The system will clearly separate the proportions to see which type of energy is used or what the factory consumes the most energy, which will be variable to that type of energy that emits the most greenhouse gases, for example, Emitted from using the most electricity? Will the operator reduce electricity consumption or not? to reduce carbon emissions from electricity. In addition to looking at hourly, daily, monthly, yearly There is also a channel to compare the amount of carbon in the past 12 months, the past 1 year or the past 5 years, how it is for efficiency in improving the production system.

One of the highlights of SCADA GENESIS64™ is that it is able to calculate the actual tax that an organization or industry has to pay by multiplying the amount of energy emitted by the amount of tax that the government determines where the energy source comes from and how much tax will I have to pay? The system will process whether the carbon emissions exceed the quota and how much tax will be paid or if there is any remaining quota, how much can be sold as carbon credits. You can also create a report form freely to submit a project certification by the Thailand Greenhouse Gas Management Organization (Public Organization) or TGO, which collects agencies, organizations, industries that are subject to carbon tax into the system and publicize it to everyone to know that around 2025, every organization will be subject to a carbon tax. Which everyone can submit carbon emission data from now on to be listed in the TGO system that our company or products have been certified carbon by the TGO.

SCADA GENESIS64™ not only helps the industry to control carbon emissions to reduce global warming, but also opens up another way to earn carbon credits. The carbon credit market will be traded similarly to cryptocurrencies, for example Company A has a large area, does not consume carbon quotas, or uses renewable energy throughout the system so that it does not have to pay a carbon tax. The quota can be sold to Company B that uses more carbon than the quota. The GENESIS64™ system has a calculation system that government agencies can inspect accurately and easily. It allows the auditor to check the calculation method from the beginning to become a credit for trading with other companies in the carbon credit market.

As mentioned at the beginning, today the European and American markets have already begun to prepare for a carbon tax. In part of the government's actions to help entrepreneurs, the TGO has developed an Embedded Emission system to measure specific greenhouse gas emissions in accordance with EU standards according to CBAM measures and develop auditors according to EU standards to help reduce costs and costs of export entrepreneurs, including negotiating with the EU, allowing Thai entrepreneurs to use carbon credits from Thailand's voluntary greenhouse gas reduction projects (T-VERs) to reduce the burden of purchasing CBAM Certificates for exporters.

While Mitsubishi Electric Factory Automation (Thailand) Co., Ltd. or MELFT aims to help push and develop Thai industry into the 4.0 system with a team of engineers trained from Japan in order to support and upgrade the Thai manufacturing industry to be modern and automated. Increase efficiency and reduce energy consumption, including production costs, both short-term and long-term, increase opportunities and compete in the global market as a smart factory under the e-F@ctory concept, which SCADA GENESIS64™ is considered one of the Mitsubishi Electric's tools that can help Thai entrepreneurs overcome the carbon tax trap in the future.

There are many more details of other functions that are useful to SCADA GENESIS64™ operators. Find answers in the Driving Sustainability by DIGITALIZING for Plastics Industry seminar held on May 10-13, 2023 at Bangkok International Trade & Exhibition Centre: BITEC, Bangna, Bangkok

Those interested can register to listen free of charge via this link to pre-register: https://bit.ly/MELFT-INTERMACH2023

Remark: Narrated in Thai language.